For many employees, the pay slip is something received once a month and quickly filed away, but it’s one of the most important documents in your professional life. Whether you’re starting your first job or managing several income streams, understanding your payslip helps you track your earnings, deductions, and overall financial health.

According to a 2024 study by the Chartered Institute of Payroll Professionals (CIPP), nearly 40% of employees don’t fully understand the details listed on their pay slips. This lack of understanding can lead to confusion, missed errors, or even underpayments that go unnoticed.

This guide breaks down what a pay slip is, how to read a pay slip, and why it matters, so you can feel confident about every amount listed on that small but powerful piece of paper.

What Is a Pay Slip?

A pay slip, also written as “payslip” is an official document issued by your employer each time you receive your salary. It provides a detailed record of how your earnings were calculated, including your basic pay, bonuses, deductions, and net salary.

In simple terms, the meaning of a pay slip is that it acts as proof of your income and helps you understand how much you earned, how much was deducted, and how much you actually take home.

Employers are often legally required to issue a pay slip, whether in printed form or electronically, to maintain transparency and comply with labor laws.

Why Understanding Pay Slips Matters

Knowing how to read your payslip isn’t just about curiosity; it’s about financial control. When you understand your pay slip, you can:

- Verify that your salary and overtime payments are correct.

- Detect any errors in deductions or tax contributions.

- Keep accurate records for loan applications or visa documentation.

- Understand how benefits, allowances, and bonuses affect your total pay.

A well-understood pay slip empowers employees to manage their money better and communicate confidently with HR or finance departments when issues arise.

How to Read a Pay Slip

When you first look at your pay slip, it may seem like a page filled with numbers and abbreviations. But once you know what each section represents, it becomes much easier to interpret.

Let’s break down the main parts you’ll typically find when learning how to read a payslip or pay slip.

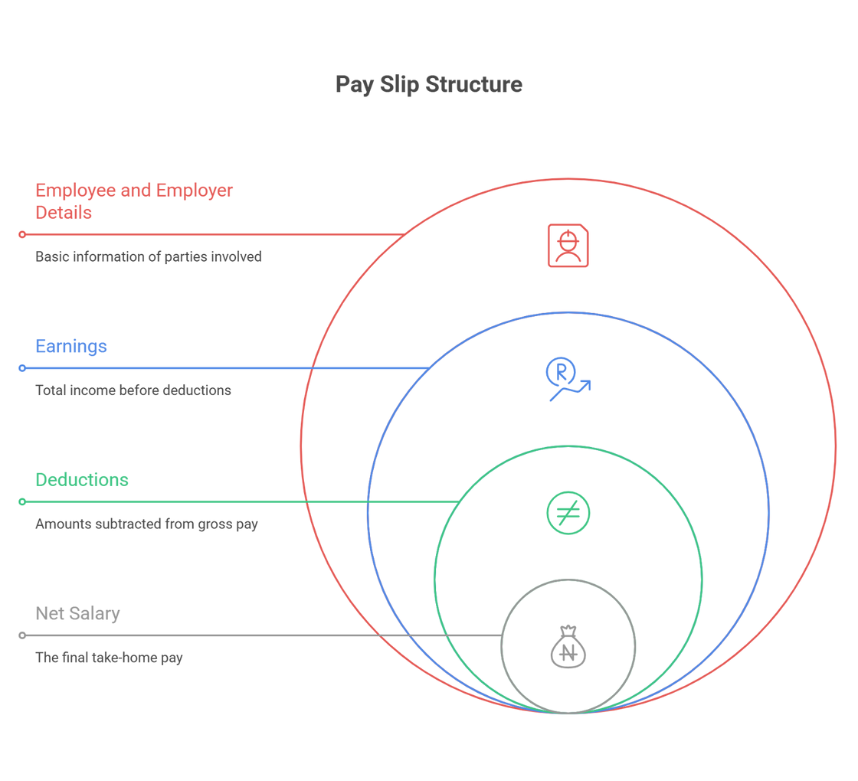

1. Employee and Employer Details

This section includes your name, employee ID, department, and the company’s name. It ensures that the pay slip belongs to you and provides a reference for HR records.

2. Pay Period

This indicates the specific month or pay cycle for which the salary was calculated, for instance, “Pay Period: 01–31 March 2025.”

3. Earnings Section

The earnings area lists the components that make up your gross salary, such as

-

Basic Salary:

The core of your pay structure. -

House Rent Allowance (HRA):

A fixed amount or percentage to cover living expenses. -

Bonuses or Incentives:

Additional payments based on performance or targets. -

Allowances:

Such as travel, medical, or communication allowances.

Adding up these amounts gives you your gross pay, which is the total amount earned before any deductions.

4. Deductions Section

This section outlines all the deductions that reduce your gross pay to your net pay, or take-home salary. Common deductions include:

-

Tax Withholding:

Income tax or other applicable government taxes. -

Provident Fund (PF):

Retirement savings contributions. -

Health or Social Insurance:

Employee welfare-related deductions. -

Loan or Advance Repayments:

If applicable.

Always review these deductions to ensure accuracy. Even a small error can affect your total pay.

5. Net Salary

The net salary, or take-home pay, is the final amount credited to your bank account after all deductions. This figure represents what you actually receive.

6. Year-to-Date (YTD) Summary

Some pay slips include a YTD summary showing cumulative earnings and deductions for the financial year. This helps in tracking annual income for tax filing or financial planning.

Common Terms You’ll See on a Pay Slip

To make it easier to interpret your payslip, here are a few frequently used terms and their meanings. Understanding these terms is a key step toward financial literacy and confidence in your earnings.

| Term | Meaning |

|---|---|

| Gross Pay | Total salary before any deductions |

| Net Pay | Final salary after deductions |

| Tax Deducted at Source (TDS) | Tax withheld by the employer on behalf of the government |

| Allowances | Additional payments for specific purposes like travel or housing |

| Overtime Pay | Extra pay for working beyond standard hours |

Common Mistakes Employees Make When Reading Pay Slips

Even experienced professionals sometimes overlook details. Here are common mistakes to avoid:

- Ignoring small deductions, assuming they’re correct.

- Not checking bonus calculations or overtime rates.

- Misunderstanding abbreviations, for example, confusing PF with insurance.

- Discarding pay slips without saving digital copies for records.

Keeping a consistent record of your payslips is essential; they can serve as proof of employment, income, and tax compliance.

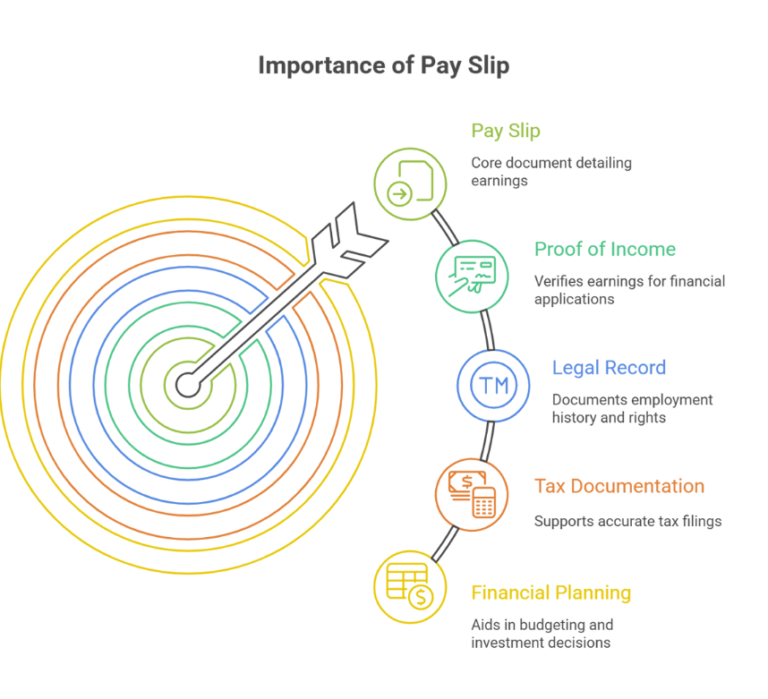

Importance of a Payslip

The importance of a payslip extends far beyond knowing your monthly earnings. Here’s why it truly matters:

Proof of Income

Required for bank loans, credit cards, and rental agreements.

Legal Record

Acts as evidence of your employment and income for disputes or verification.

Tax Documentation

Helps you file accurate tax returns and stay compliant.

Financial Planning

Enables you to budget better and track expenses effectively.

Simply put, understanding what a pay slip is and how it works can make a big difference in your financial awareness and career stability.

Best Practices for Managing Pay Slips

Final Thoughts

Your pay slip isn’t just a document; it’s a financial mirror that reflects your professional worth, benefits, and contributions.

By taking a few minutes each month to review and understand it, you ensure transparency, accuracy, and financial confidence.

Whether you call it a payslip or a salary slip, knowing how to read your pay slip gives you better control over your income and a clearer understanding of your financial journey.